Our organization is actively seeking skilled and dedicated individuals to join our team. If you are looking for an exciting opportunity to advance your career, we encourage you to apply.

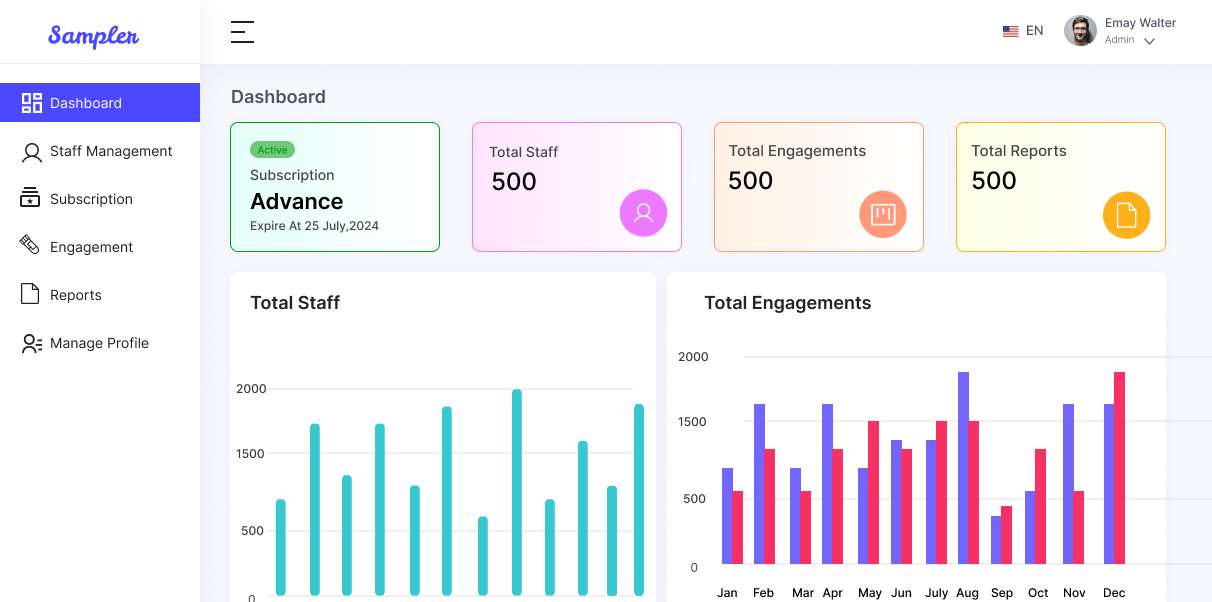

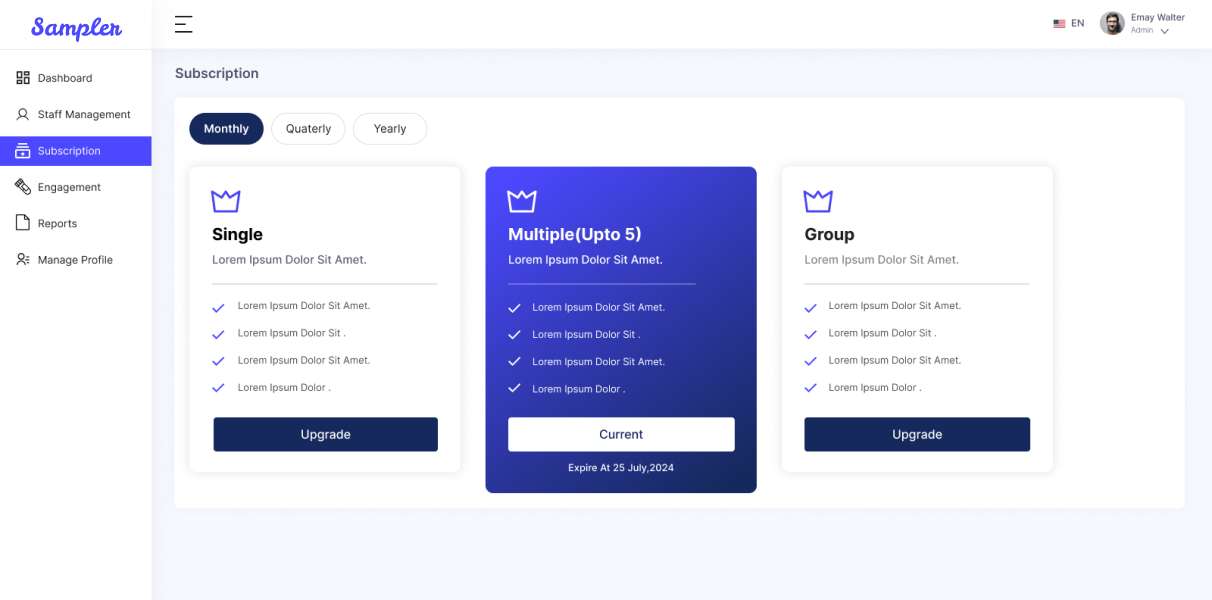

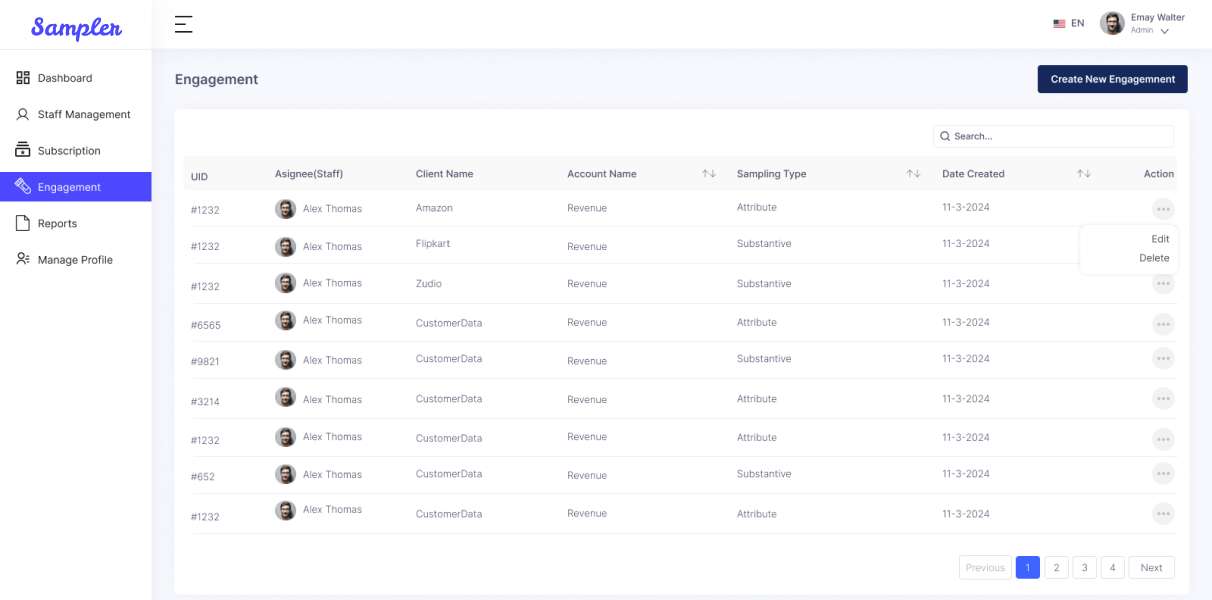

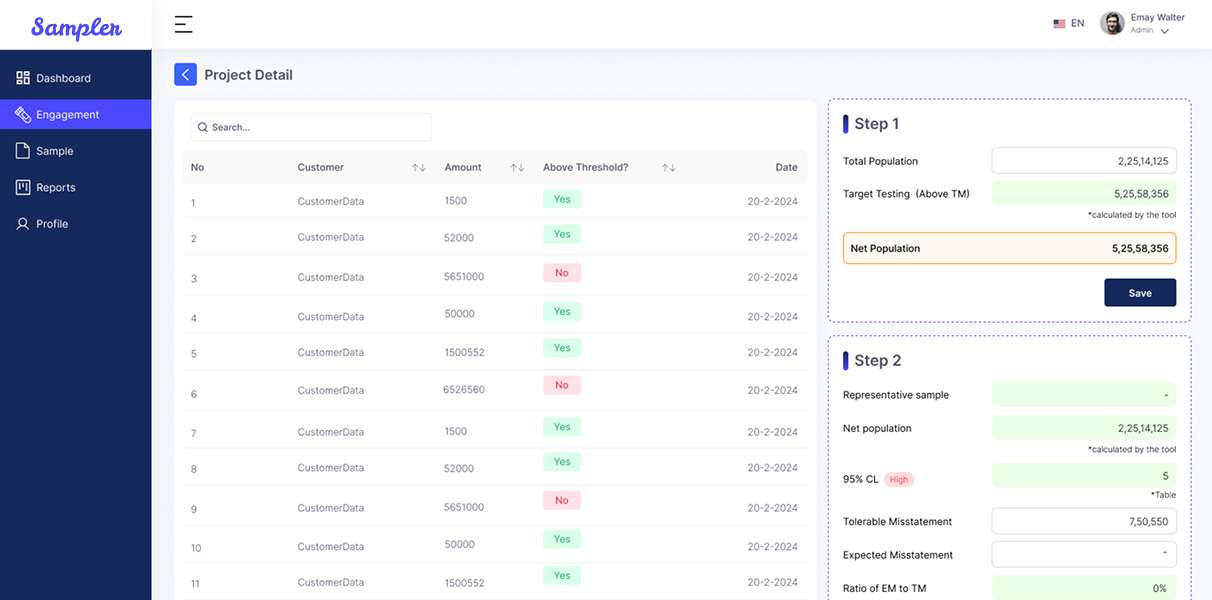

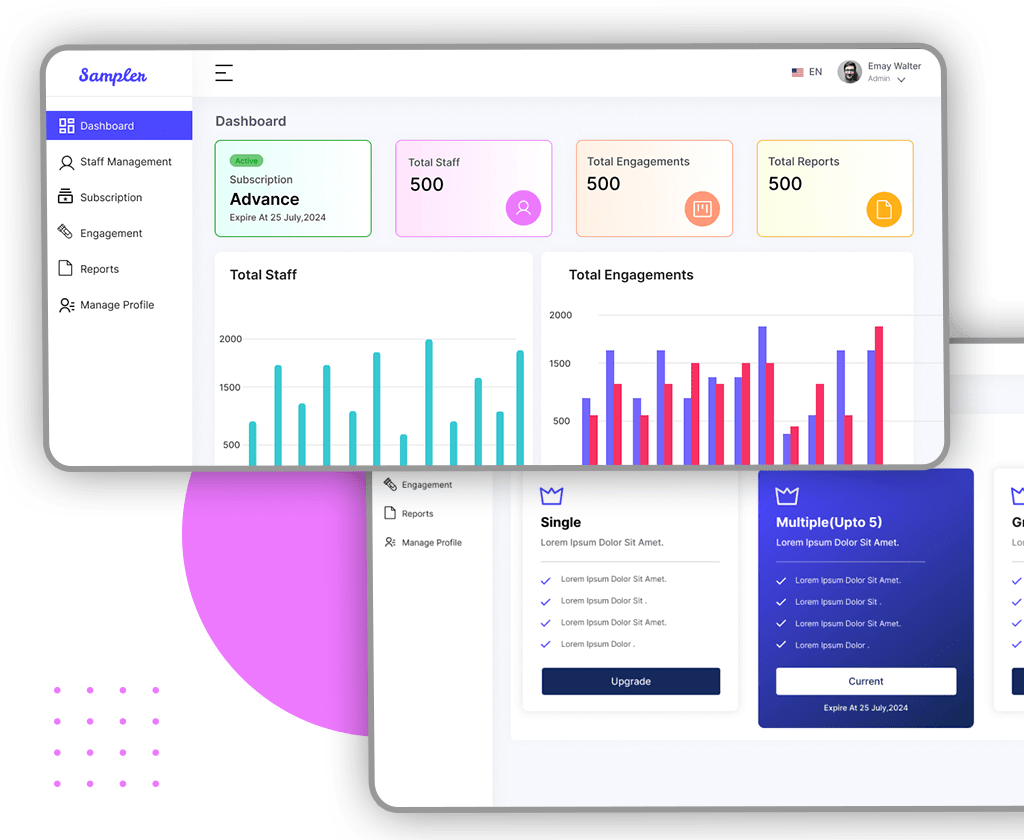

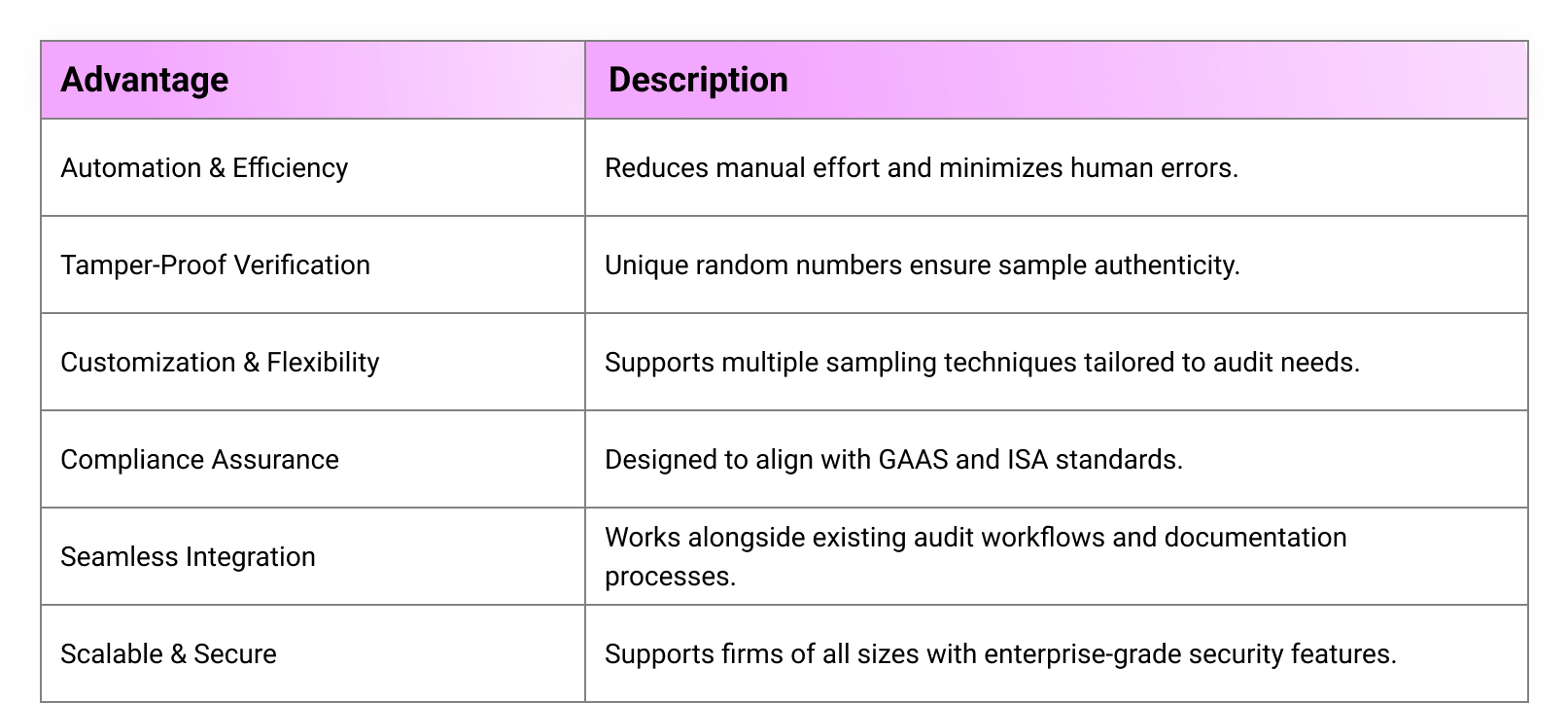

In today’s highly regulated financial landscape, audit firms are under increasing pressure to ensure accuracy, transparency, and compliance. The audit sampling process, a fundamental component of financial oversight, plays a crucial role in detecting discrepancies, mitigating risks, and ensuring regulatory adherence. However, traditional sampling methods are often time-consuming, prone to errors, and susceptible to manipulation, leading to inefficiencies and potential compliance risks. The global auditing industry is evolving rapidly due to increased regulatory scrutiny, advancements in data analytics, and the growing need for automation. Key Challenges: ✔ Manual and error-prone data sampling methods These challenges create a significant gap in the market for a solution that streamlines audit sampling, enhances compliance, and improves efficiency without compromising data integrity. To bridge the identified gaps, audit professionals require a solution that: Audit sampling techniques are primarily classified into two categories: Attribute Sampling and Substantive Sampling, each serving distinct purposes in audit engagements. Attribute Sampling Substantive Sampling To address these pressing challenges, we have developed an audit sampling tool that leverages automation, security, and precision. Designed by auditors for auditors, our platform simplifies and enhances the audit sampling process through: Key Features: Automated Data Upload & Processing: Secure CSV uploads streamline data handling. Smart Sample Selection: AI-driven selection of significant transactions based on risk parameters. OCR Technology Integration: Extracts data from invoices and converts them into CSV files for efficient sampling and analysis. Customizable Sampling Techniques: Attribute sampling for control testing and substantive sampling for balance testing. Optimized Sample Size Calculation: Ensures statistically sound sample sizes. Multiple Selection Methods: Random, systematic, and monetary unit sampling (MUS) for flexibility. Easy Report Generation: Downloadable CSV and PDF reports with unique verification numbers. Role-Based Access Control: Super Admin, Company Admin, and Staff roles for secure and structured workflow management. Integrated Client Communication: Direct sample sharing with audited entities for better collaboration. Data Security & Compliance: Advanced encryption and security protocols to protect audit data. ✔ User Authentication: Secure login with role-based access control. By implementing our audit sampling solution, our client’s firm have reported: 50% Reduction in Sampling Time: Automation streamlines tedious processes. In an era of heightened financial scrutiny, our audit sampling tool redefines efficiency, compliance, and security. By addressing the core challenges faced by auditors, we empower firms to conduct precise, reliable, and standardized audits. We provide an all-in-one solution for easy and accurate audit sampling. Our commitment to continuous innovation is shaping the future of audit sampling—one automated, secure, and transparent engagement at a time. Automated Audit Sampling Software: Easy, Efficient & Accurate

Context

Market Context & Problem Statement

✔ Lack of standardization across audit engagements

✔ Time-intensive sample selection and verification processes

✔ Difficulty in maintaining compliance with GAAS and ISA standards

✔ Challenges in integrating sampled data into audit workflows

✔ Absence of a secure and tamper-proof method for sample verification

✔ Lack of automated data extraction from invoices for accurate sampling

Market Needs (Asks)

Understanding Attribute Sampling & Substantive Sampling

Attribute sampling checks whether internal controls are working properly. It helps find out if rules and procedures are being followed. Auditors use it to test things like whether transactions get the required approvals. For example, an auditor might look at a sample of purchase orders to see if they were all approved by management.

Substantive sampling, on the other hand, checks if financial numbers are accurate and free from big mistakes. It helps make sure financial reports are correct by verifying details like accuracy, completeness, and value. For example, an auditor might check a sample of accounts receivable to see if the records match supporting documents and truly exist. Our Solution

Operational Workflow

✔ Project Creation: Auditors set up engagement details and upload transaction data.

✔ Sample Selection: AI-driven analysis selects significant samples based on predefined criteria.

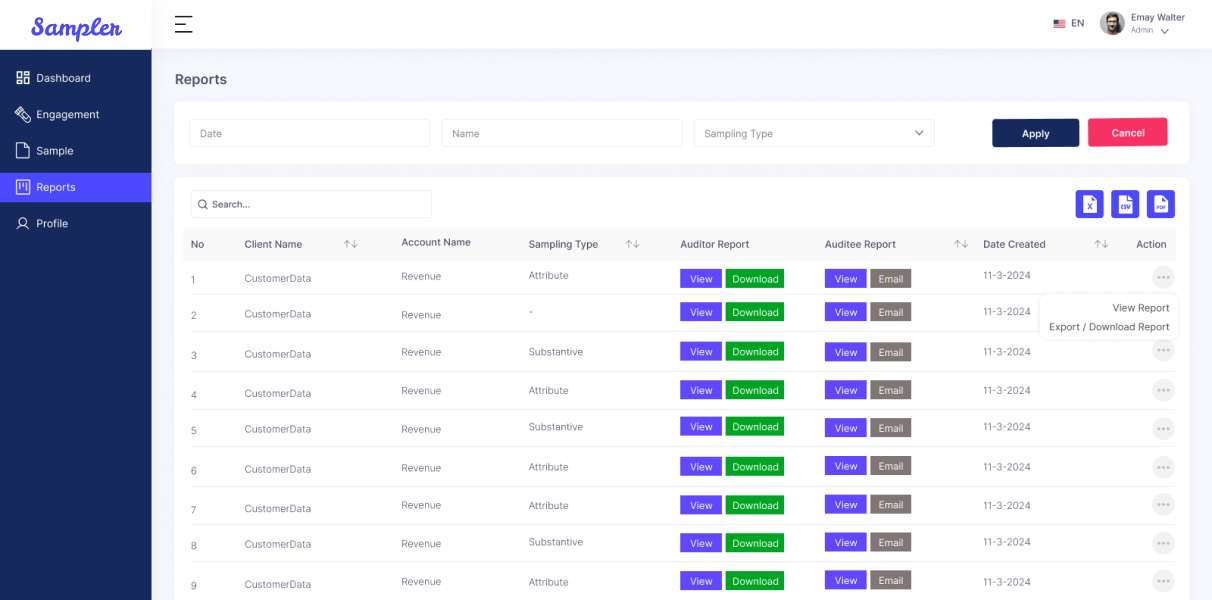

✔ Sampling Report Generation: Automated reporting and export options for seamless documentation.

✔ Verification & Review: Built-in random number verification for enhanced integrity.

✔ Client Engagement: Secure communication with audited entities to share sample data. Competitive Advantage

Impact on our client’s business

Enhanced Accuracy & Reliability: AI-driven selection minimizes human error.

Improved Compliance & Security: Ensuring audits meet the highest industry standards.

Seamless Auditor-Auditee Collaboration: Direct sample sharing enhances transparency.

Efficient Invoice Data Handling: OCR technology accelerates financial data extraction and analysis. Conclusion