Our organization is actively seeking skilled and dedicated individuals to join our team. If you are looking for an exciting opportunity to advance your career, we encourage you to apply.

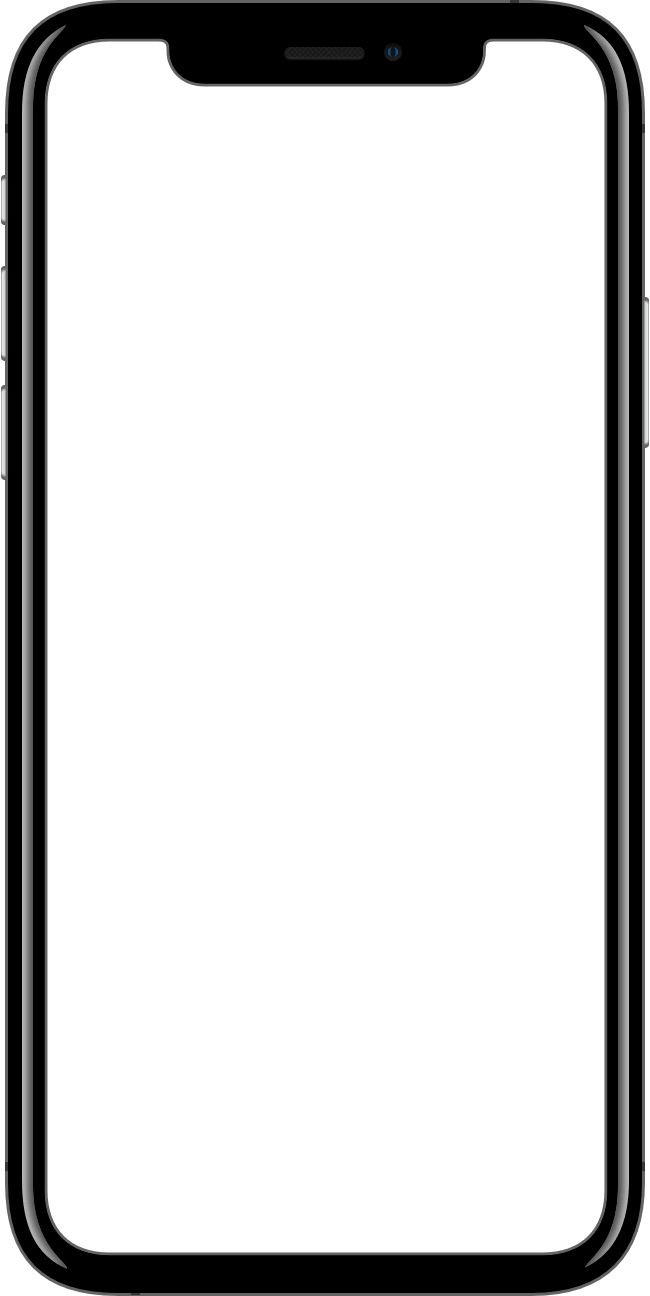

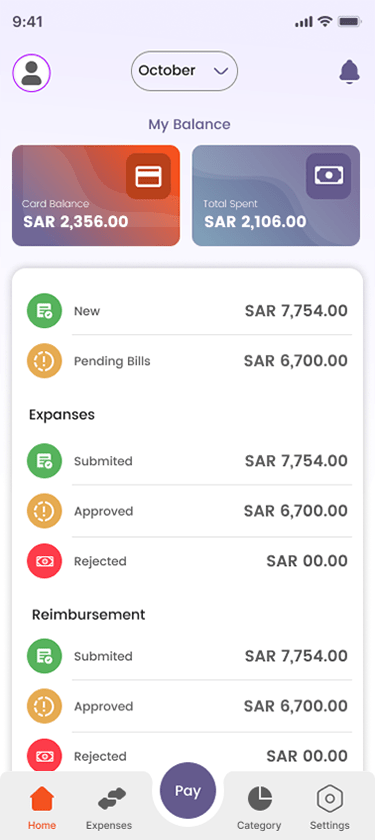

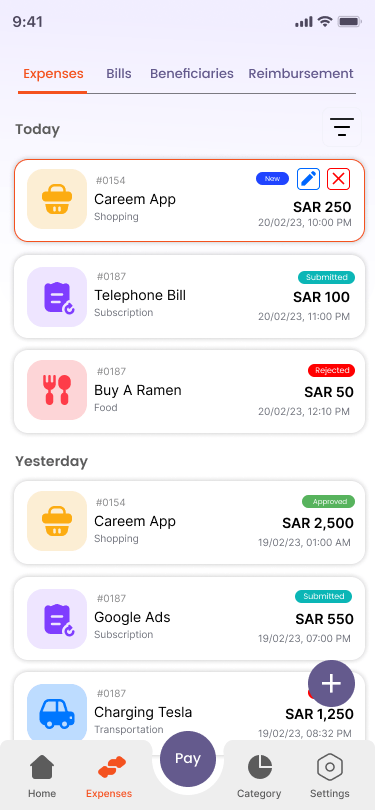

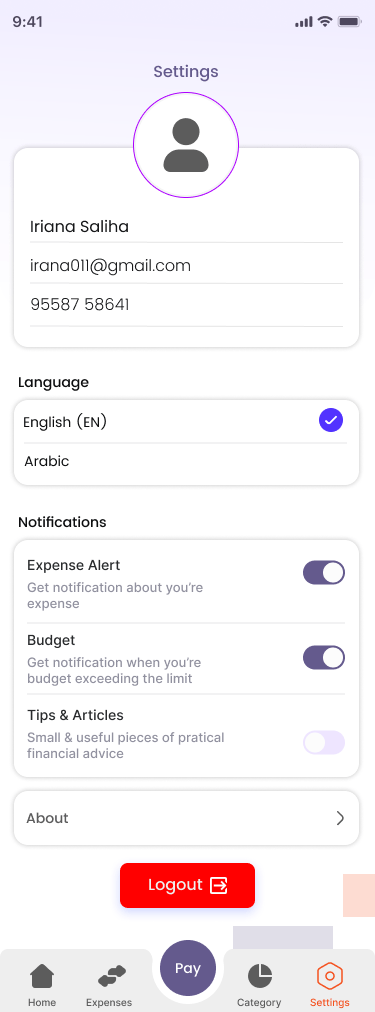

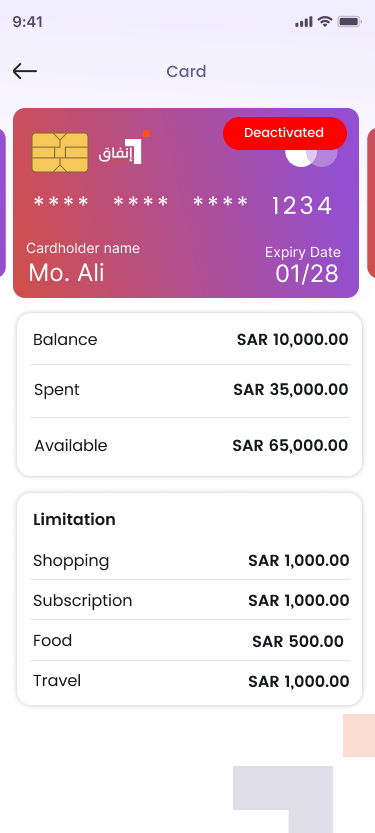

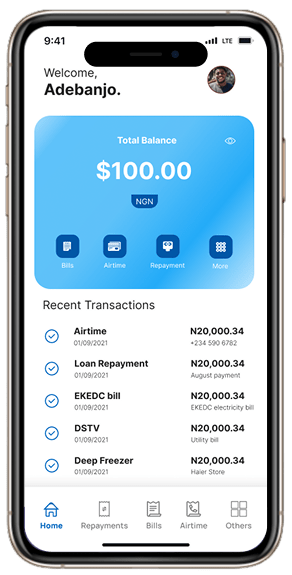

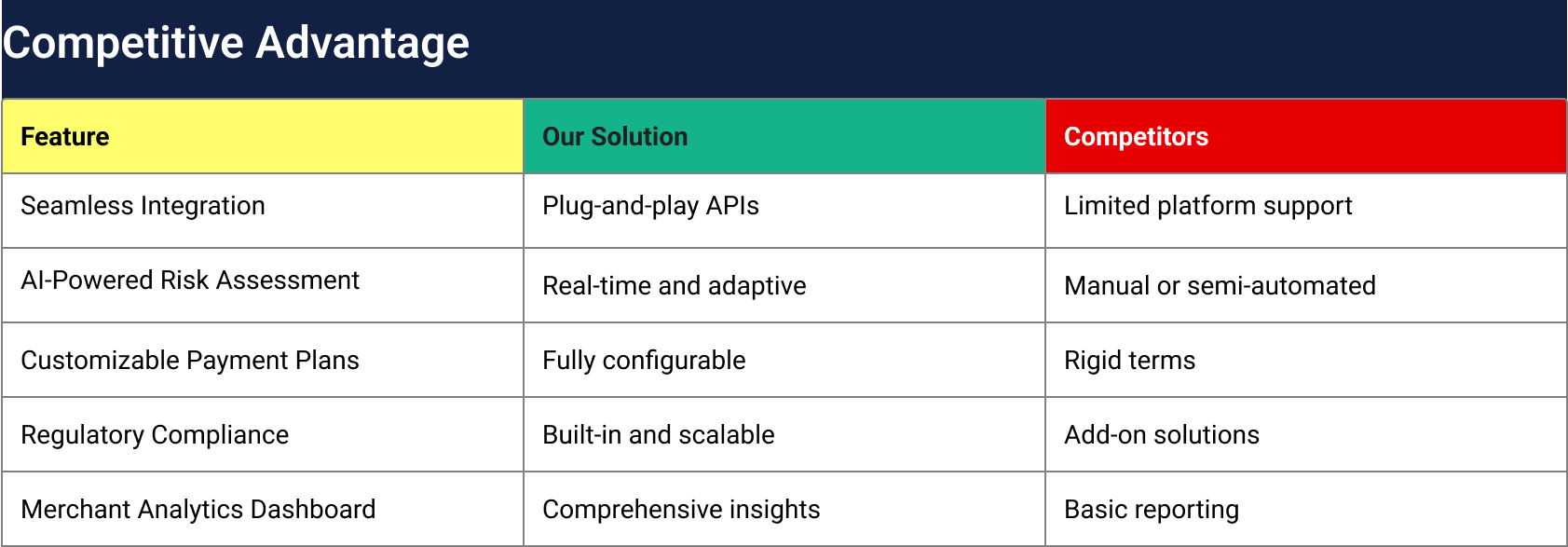

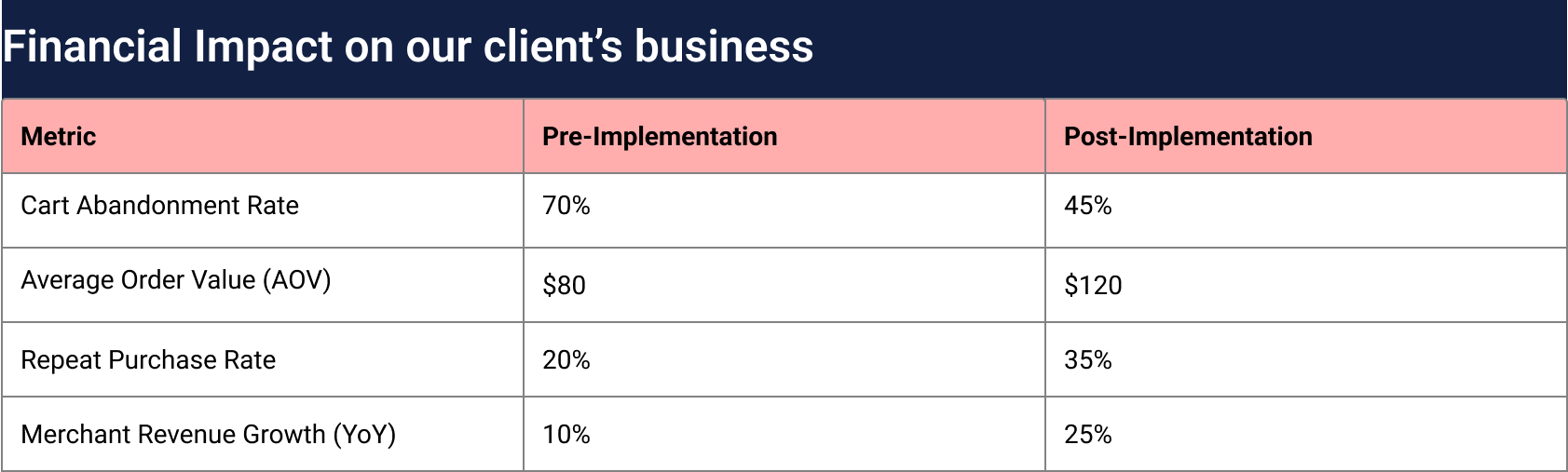

In the ever-evolving e-commerce landscape, consumer expectations are higher than ever. One significant shift in consumer behavior is the growing demand for flexible payment options. “Buy Now, Pay Later” (BNPL) solutions are becoming increasingly popular, particularly among younger consumers who value convenience and flexibility. This case study explores how our we have developed an Advanced BNPL payment gateway tailored for the e-commerce sector, addressing market challenges and creating tangible financial benefits for both merchants and consumers. Limited Financial Flexibility for Consumers: Many consumers face cash flow constraints, particularly during economic uncertainty. Traditional credit options are often rigid and come with high interest rates, deterring users. High Cart Abandonment Rates: Studies show that 70% of online shopping carts are abandoned. One of the primary reasons is the lack of attractive and seamless payment options. Merchant Challenges with Customer Acquisition and Retention: E-commerce merchants struggle to differentiate themselves in a saturated market. Offering flexible payment options can significantly improve customer loyalty but implementing such systems is complex and resource-intensive. Regulatory and Compliance Concerns: Fintech solutions, especially those offering credit, face stringent regulatory requirements. Ensuring compliance while maintaining a seamless user experience is a significant hurdle. Consumer Side: Merchant Side: We designed and implemented a state-of-the-art BNPL payment gateway to address our client’s challenges effectively. Key Features Faster Time-to-Market: Merchants can integrate our solution in under 24 hours, reducing deployment time significantly. Enhanced Customer Retention: Merchants offering our BNPL solution report a 35% increase in repeat purchases. Low Operational Costs: Our scalable architecture ensures minimal overhead for merchants. Expansion into Emerging Markets: Targeting regions like Southeast Asia, Africa, and Latin America where credit access remains a challenge. Introducing localized solutions with multi-currency and multi-language support. Integration with Loyalty Programs: Partnering with merchants to reward customers for timely repayments, fostering loyalty. Blockchain for Transparency: Exploring blockchain technology to ensure transaction security and enhance transparency. Financial Literacy Initiatives: Developing educational tools and resources to help consumers better understand and manage their credit. Merchants adopting our solution have witnessed a significant boost in key performance indicators, particularly a 50% increase in AOV and a 25% reduction in cart abandonment. The rapid rise of BNPL solutions underscores their importance in the evolving e-commerce ecosystem. Our advanced payment gateway addresses both consumer and merchant challenges, offering a seamless, flexible, and compliant solution. Advanced BNPL Payment Gateway

Context

Market Context & Problem Statement

Market Needs (Asks)

✔Easy, transparent, and low-interest payment plans.

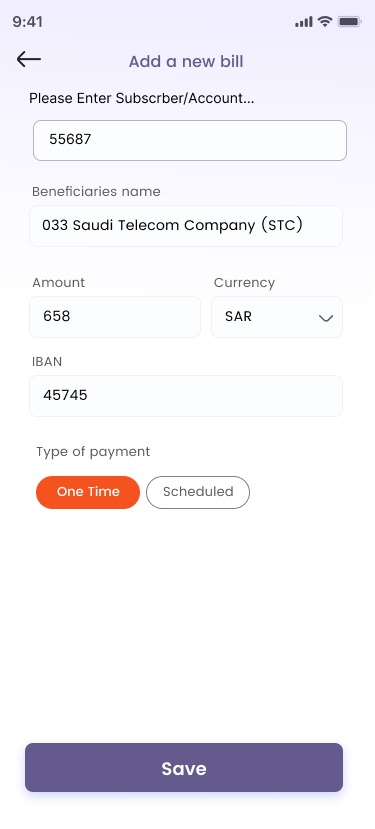

✔Instant approval processes with minimal friction.

✔Enhanced financial literacy and transparency on repayment terms.

✔ Increased conversion rates and reduced cart abandonment.

✔ Seamless integration with existing e-commerce platforms.

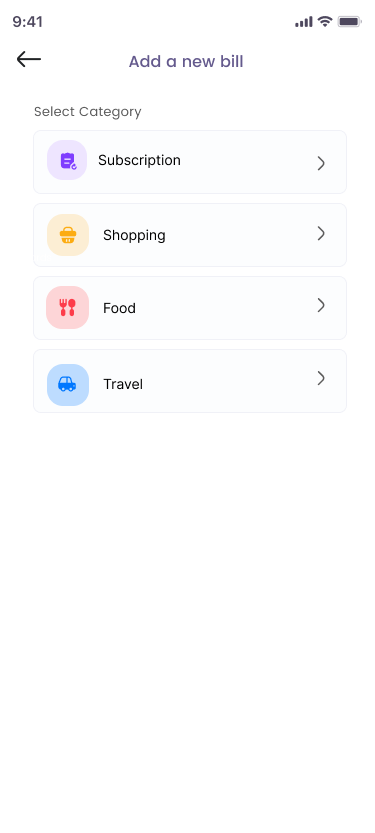

✔ Comprehensive analytics to track customer behavior and transaction trends. Our Solution: Advanced BNPL Payment Gateway

Operational Workflow

Competitive Advantage

Future Vision

Financial Impact on our client’s business

Conclusion

By focusing on innovation, scalability, and transparency, our solution not only solves current market pain points but also positions itself as a leader in the future of fintech. As we continue to expand and refine our offering, the financial and operational benefits for merchants and consumers will only grow, cementing our role as a transformative player in the BNPL space.